Source: Untar Public Relations – VA

Tarumanagara University (Untar) continues to demonstrate its commitment to enriching students’ perspectives—not only through theoretical knowledge but also by fostering an understanding of current issues. One such effort was reflected in a Tax Webinar themed “Humanities and Taxation: The Impact of Government Travel Budget Cuts and Global Trade Wars on Indonesia’s Tourism Growth and Tax Revenue,” held online via Zoom on Wednesday, May 14, 2025.

The webinar was attended by all students enrolled in the Humanities course for the even semester, along with faculty deans, program heads, course coordinators, and lecturers. The event was opened by the Head of Untar’s Center for Learning and Academic Innovation, Dr. Ir. Steven Darmawan, S.T., M.T., who expressed his appreciation to the speakers and participants. He hoped that the insights gained could be meaningfully applied in students’ daily lives and their contributions to society.

The first speaker, Ngadiman, S.E., S.H., M.Si.—Chairman of the National Tourism Association (ASPARNAS) and lecturer at Untar’s Faculty of Economics and Business—emphasized the importance of public support for local products and the tourism sector as a direct contribution to national economic development. He also highlighted the crucial role of improving human resource quality to ensure Indonesia’s competitiveness amid global challenges. “We can support the country by using local products, promoting domestic tourism, and enhancing our human resources to compete with other nations,” he explained.

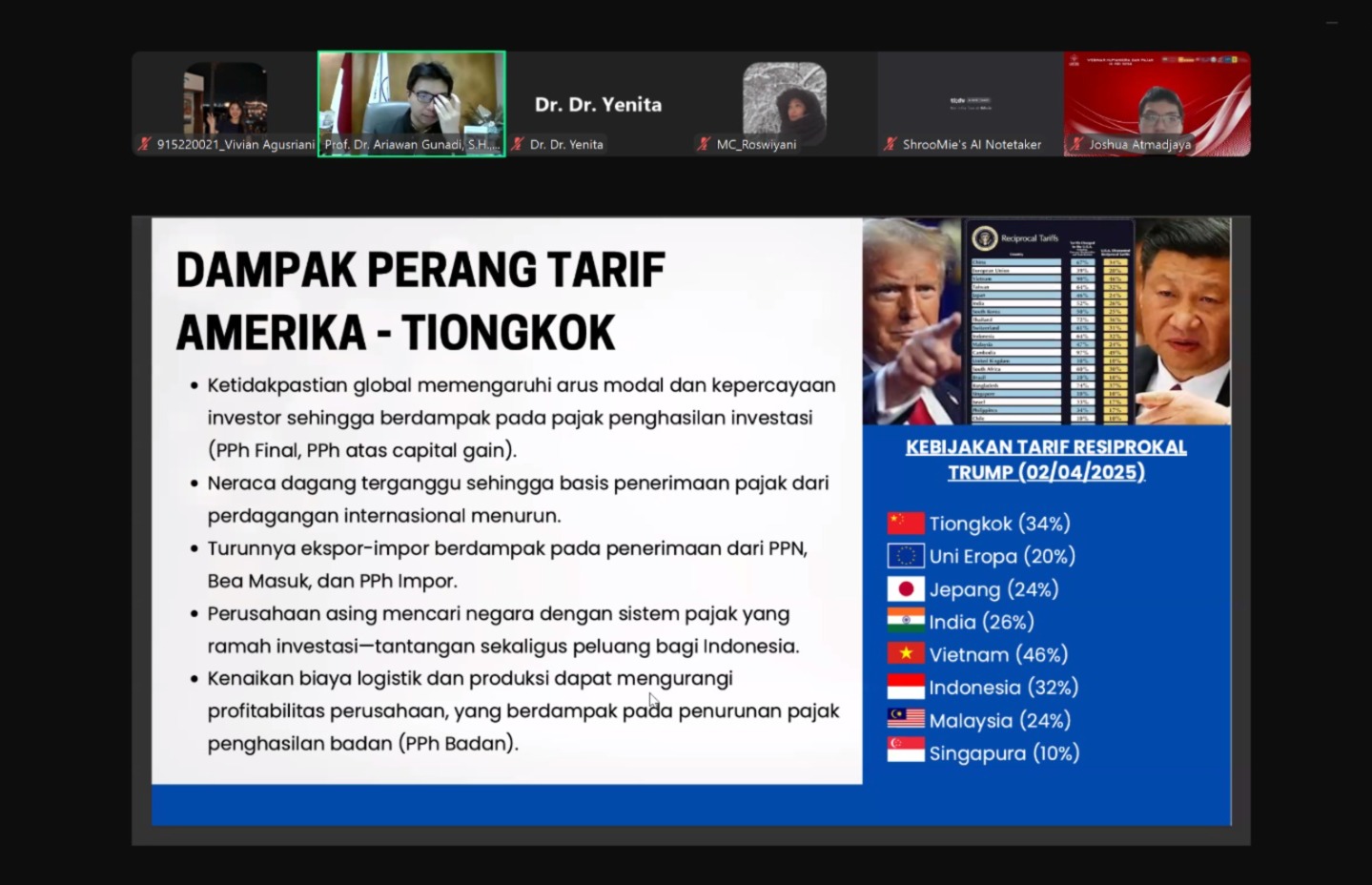

Meanwhile, Prof. Dr. Ariawan Gunadi, S.H., M.H., Chairman of the Tarumanagara Foundation Board, discussed how global dynamics—such as the trade war between the United States and China—have created uncertainty that affects investment flows and the country’s tax revenue. He stressed that such fluctuations pose a significant challenge in formulating sustainable fiscal policies.

Furthermore, Prof. Ariawan also highlighted the vital role of the humanities in shaping moral awareness and social responsibility, including in matters of tax compliance. “The humanities are essential because they help cultivate moral awareness and social responsibility. Ethical, cultural, and religious values can encourage voluntary tax compliance without coercion,” he stated.

Through this webinar, Untar encouraged students to understand that taxes are not merely an administrative obligation, but a tangible contribution—an expression of their role as future citizens who are active and responsible in supporting national development.

(VA/AJ)